Transform, Optimize

Boost Operational Efficiency with Qanty

Turn digital queue management into customer loyalty

Physical lines frustrate customers and burn out staff. Discover how digital queue management transforms waiting into a smooth, controlled experience, optimizing your operations from day one in clinics, government offices, universities, and retail.

This article explores how a service orchestration platform eliminates the uncertainty of waiting. We’ll break down its key capabilities, from real-time monitoring to analytics, and the direct impact on customers, staff, and management.

Transforming how people wait in line is no longer optional. Whether at a clinic, government office, university, or retail store, customers expect speed, clarity, and convenience. The traditional physical line fails on all three counts, creating friction and frustration.

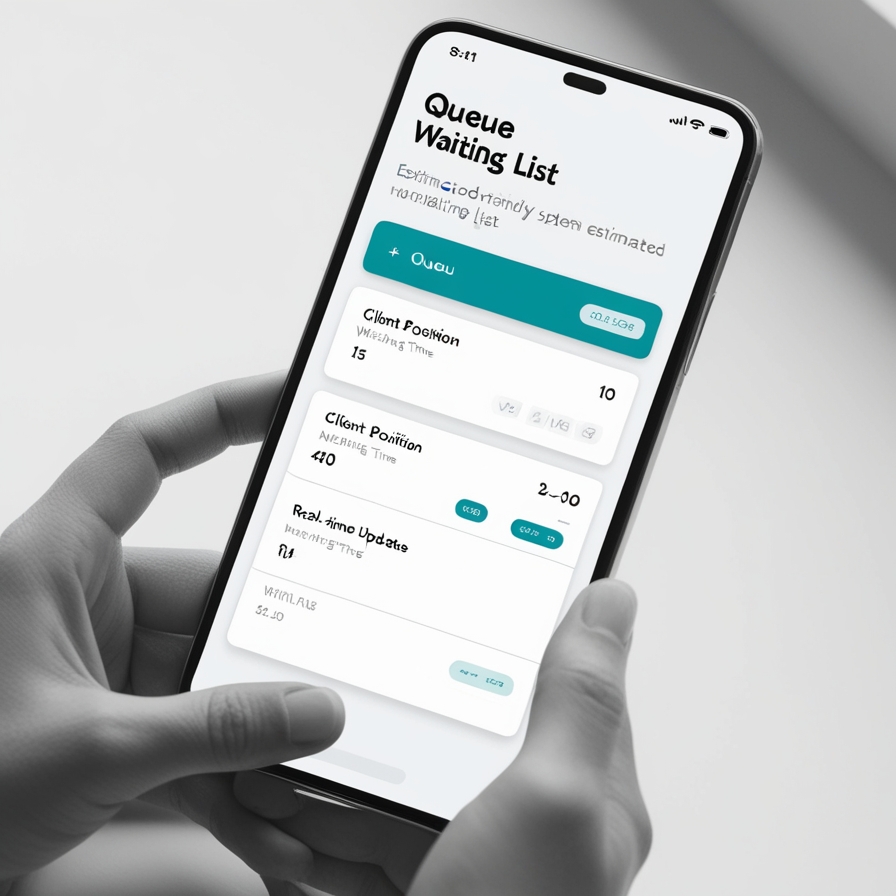

Qanty replaces the frustration of physical lines with a digital experience. When customers arrive, they can easily take a ticket from a kiosk, scan a QR code, or join the queue online using their phone. Once in line, Qanty keeps them informed in real time—showing estimated waiting times, current position, and even notifications when it’s almost their turn.

This empowers visitors to relax, move freely, or prepare for their appointment instead of standing and waiting.

The True Cost of Waiting?

Studies show that 75% of customers are only willing to wait a maximum of 5 minutes. Long wait times are consistently rated the #1 frustration in service experiences.

Qanty is more than a ticketing tool — it’s a complete queue and service orchestration platform. It’s built for modern organizations that need visibility and control over their entire service flow.

Key capabilities include:

An effective digital queue system creates a win-win-win scenario, enhancing all sides of the service experience.

Qanty means freedom and predictability. No more uncertainty about when they’ll be attended, which dramatically reduces frustration and improves their perception of your service.

This means organization and control. No more chaos at the counter. Staff can manage the flow with smart data, anticipate demand, and focus on service delivery.

Qanty delivers clarity. Visual dashboards and reports make it easy to identify bottlenecks, measure service quality, and improve overall performance based on real data.

Your service platform must be reliable and secure. Qanty is built on a serverless web architecture (Vue + Firebase/GCP), which ensures:

This modern foundation guarantees that your service operations are always on, always secure, and always up-to-date.

To ensure a smooth transition and maximize your return on investment, follow these key best practices:

The right technology isn’t just a tool; it’s the foundation for a superior and efficient service strategy.

It’s a system that replaces physical lines. It allows customers to register (via mobile, QR, or kiosk) and wait for their turn remotely, receiving real-time updates on their position and estimated wait time.

Yes. A true service orchestration platform like Qanty is built to scale. It allows management to monitor and manage performance across multiple locations or departments from a single, centralized dashboard.

Any industry where people wait. This includes clinics and hospitals (healthcare), government offices, bank branches, university service desks, and retail stores (especially for customer service or click-and-collect).

It eliminates counter chaos and the constant ‘how much longer?’ questions. Staff get an organized, digital view of demand, allowing them to manage the flow, reduce stress, and focus on quality service instead of crowd control.

Visit www.qanty.com to discover how your organization can transform its queue management today. Request a personalized demo to see it in action.

Emergency rooms are incredibly demanding. Every minute counts, but many ERs still rely on calls or radios to notify nurses of a patient’s arrival. That’s where Qanty, an intelligent Queue Management System (QMS), comes in. We connect the front desk to the triage and treatment staff in real time, ensuring nurses are instantly informed to improve response times and efficiency.

When a patient checks in at the ER front desk or kiosk, Qanty automatically updates a centralized dashboard accessible to all staff. Nurses in triage or treatment areas can see:

This eliminates the need for manual calls or repeated updates, giving nurses instant awareness of who’s waiting and how long they’ve been there.

With live updates, the triage team can act faster. Qanty’s system allows hospitals to define priority tags or alerts. If a patient reports chest pain or another critical symptom during check-in, the system automatically flags it to nurses.

This proactive alerting helps ensure that no critical case goes unnoticed, even during high-traffic hours.

In busy ERs, communication breakdowns are common. Qanty bridges this gap by enabling seamless coordination between departments. Everyone—from registration staff to triage nurses—works off the same data in real time.

Notifications can also be configured to appear on monitors, tablets, or mobile devices, ensuring that the right person sees the update immediately, no matter where they are in the unit.

Long waiting times are one of the main sources of frustration in ERs. With Qanty, hospitals can display estimated waiting times or status updates on patient-facing screens, improving transparency and reducing anxiety.

When patients feel the process is organized and that staff are aware of their arrival, overall satisfaction increases significantly.

Every check-in, wait time, and service duration is recorded in Qanty’s analytics system. This provides valuable insights for hospital administrators to identify bottlenecks, measure staff response times, and optimize resource allocation.

For instance, data might reveal that certain hours of the day consistently have longer triage delays — helping managers adjust staffing accordingly.

Qanty can integrate with existing hospital systems (EHRs, patient management tools, or internal alert systems), reducing the learning curve for staff.

Its modular design allows ERs to start with basic check-in and alert functions and later expand to include full workflow automation, kiosks, or patient communication tools.

Did you know?

In busy emergency rooms, communication breakdowns are a leading cause of treatment delays and patient dissatisfaction. A real-time notification system closes this gap, instantly connecting the front desk with the triage team.

Qanty uses a centralized dashboard that updates in real time. These notifications can be displayed on large monitors in nursing stations, as well as on staff tablets or mobile devices, ensuring they see the alert no matter where they are.

The system allows hospitals to configure “priority tags” or automatic alerts. If a patient checks in with critical symptoms (like chest pain), the system automatically flags them with high priority on the dashboard, ensuring the triage team identifies them immediately.

No. Qanty is designed to integrate with your existing systems, including EHRs and other patient management tools. It acts as a communication and workflow bridge that enhances the systems you already use, without replacing them.

Qanty records every step of the process. You can analyze key metrics like total wait times, triage duration, staff response times by hour, peak traffic, and bottlenecks. This allows administrators to make data-driven decisions to optimize staffing and workflows.

Discover how Qanty’s management system can eliminate communication gaps, reduce wait times, and empower your nursing team to focus on delivering quality care.

In this guide, you will learn what NPS is, how it is calculated through Promoters, Passives, and Detractors, and why it is considered a benchmark for growth. We will also explore the steps to implement NPS in your business—from survey design to data analysis—and share best practices to turn feedback into actionable strategies.

The Net Promoter Score (NPS) is a key metric to measure customer loyalty and predict growth. Based on a simple question, it classifies responses into Promoters, Passives, and Detractors, offering a clear view of brand perception. With NPS, businesses can track satisfaction, identify areas for improvement, and design strategies to strengthen customer relationships and long-term engagement.

In today’s highly competitive market, understanding how satisfied and loyal your customers are has become a strategic priority. One of the most widely used tools to measure this is the Net Promoter Score (NPS). This simple yet powerful metric helps organizations assess the likelihood that customers will recommend their brand to others, offering valuable insight into customer satisfaction and loyalty.

The Net Promoter Score (NPS) is a metric based on one straightforward question:

“On a scale of 0 to 10, how likely are you to recommend our company/product/service to a friend or colleague?”

Based on their response, customers are grouped into three categories:

The NPS is calculated by subtracting the percentage of Detractors from the percentage of Promoters:

NPS = %Promoters − %Detractors

The score can range from -100 to +100, giving businesses a clear indication of overall customer sentiment.

Key Fact on Customer Experience

NPS not only measures satisfaction, but also predicts customer loyalty. Companies with a high NPS grow up to 2.5 times faster than their competitors.

The Net Promoter Score (NPS) has become a global standard because it delivers several key benefits that go beyond traditional satisfaction surveys. Its simplicity and action-oriented nature make it one of the most effective tools for improving customer experience.

One core question makes it easy to collect and interpret results, reducing complexity for both customers and companies.

It measures true commitment through the willingness of customers to recommend, not just short-term satisfaction.

Companies with higher NPS often experience stronger organic growth, as happy customers generate referrals.

NPS makes it possible to compare results over time, across industries, and against competitors.

It highlights areas that need improvement and helps organizations focus on strategies that enhance customer experience.

To get the most value out of Net Promoter Score (NPS), it’s essential to implement it in a structured and consistent way. Each step ensures meaningful insights and drives action toward improving customer experience.

Decide what you want to measure: overall brand experience, satisfaction after a specific purchase, or feedback after support interactions.

Keep the NPS question simple. Add an open-ended follow-up like: “What’s the main reason for your score?” to get context-rich feedback.

Send surveys at key touchpoints: after a purchase, following support, or periodically (quarterly/biannually) to track long-term loyalty.

Identify Promoters, Passives, and Detractors. Calculate your NPS and review open comments to uncover recurring themes.

Use insights to reduce Detractors, strengthen Promoters’ loyalty, and convert Passives into Promoters through improvements.

Share findings internally, communicate improvements, and show customers that their feedback drives change—building trust and engagement.

To maximize the value of the Net Promoter Score (NPS), it’s important to follow a set of best practices that ensure accuracy, consistency, and actionable insights for your business.

At Qanty, we can help you easily implement and track this metric for your business. Contact us today to schedule a free consultation.

The Net Promoter Score (NPS) is a metric that measures customer loyalty by asking how likely they are to recommend your product or service to others.

NPS doesn’t just measure satisfaction—it measures loyalty. It helps identify promoters, passives, and detractors, allowing you to predict growth and improve the customer experience.

It’s best to keep surveys short and focused, avoiding over-surveying customers to get more accurate and useful responses.

Analyze feedback from promoters and detractors to find areas for improvement. Combine NPS with other customer experience metrics for a fuller picture.

Yes. Companies with high NPS often see organic growth because satisfied customers generate referrals and recommend your brand to others.

Every rating, every comment, every NPS score tells a story about how your customers feel. With Qanty, you can turn those insights into real actions that elevate satisfaction, build stronger relationships, and grow your brand with confidence.

Time is at the core of Customer Experience. Long, unpredictable wait times frustrate clients and damage brand perception. With Qanty’s scheduling and virtual queue management solutions, businesses can reduce waiting time, increase NPS, and turn efficiency into lasting customer loyalty.

Customers often arrive at a business ready to be served, only to face an unpredictable wait. They might stand in a long line, sit in a crowded waiting room, or have no idea when their turn will come. Every extra minute feels longer when there’s no clear timeline, and frustration builds quickly.

This wasted time doesn’t just create inconvenience, it affects the way people view your brand. Long, unmanaged waits are one of the biggest drivers of low Net Promoter Scores (NPS), reducing customer loyalty and making it less likely that people will recommend your services to others.

Qanty’s system is designed to remove uncertainty and give customers control over their time. Our appointment scheduling feature allows people to book a service slot before they arrive, ensuring they are served promptly.

For walk-in customers, Qanty’s virtual queue management lets them join a queue from anywhere through the Qanty app. While waiting, they can run errands, work, or relax instead of staying in a waiting room. Real-time notifications keep them updated on their place in line and alert them when it’s nearly their turn.

The result is a service experience where customers feel their time is respected, staff can work more efficiently, and managers can track and improve performance using Qanty’s reporting tools. By cutting wait times and reducing uncertainty, businesses see measurable improvements in NPS, as customers are more willing to share positive feedback and recommend the service.

When the time factor is handled well, customer satisfaction rises naturally. People remember the businesses that made their visit easier, not the ones where they sat and waited. A higher NPS is the reflection of that positive memory, proof that customers are not just satisfied but eager to return and refer others. Qanty gives both customers and businesses the ability to make every minute count and turn that efficiency into lasting loyalty.

Key Fact on Customer Experience

Recent customer experience research shows that over 65% of consumers consider reduced wait times as one of the most important factors in a positive service experience. This highlights that queue optimization is a direct investment in customer loyalty and brand reputation.

It gives customers control over their time, reduces frustration, and creates a smoother service experience.

Unmanaged waits lower NPS, decreasing loyalty and the likelihood of customer recommendations.

Yes, it optimizes staff allocation and reduces idle time, improving efficiency.

Through real-time updates and alerts in the Qanty app when it’s nearly their turn.

Don’t let unpredictable waits damage your brand’s reputation. With Qanty, you can give customers control over their time, improve efficiency, and boost loyalty. Contact us today to discover how our tailored solutions can help your business make every minute count.

At Qanty, we’re redefining customer experience through smart technology. Our queue management system is built to reduce wait times, improve service, and boost operational efficiency. It integrates seamlessly with self-service kiosks, smart service points, and video call modules—all powered by leading global brands that ensure quality, innovation, and dependable support.

At Qanty, we create technology solutions with a clear goal: to transform the way people experience customer service. And we do it with one non-negotiable principle: we only work with the best brands in the market. Our queue management system, for example, is built with components from Intel, HP, Epson, Elo Touch, Dell, Kingston, Honeywell, Bixolon, and Star Micronics.

These aren’t just logos—they’re a guarantee of performance, reliability, and support. They’re our technology partners, helping us deliver solutions that are robust, efficient, and scalable—especially in high-demand environments where every second matters and user experience defines business success.

Our queue system isn’t just about organizing lines—it’s a core part of a larger service ecosystem. It connects with self-service kiosks, smart counters, and video call modules, all tailored to your organization’s specific needs and supported by high-quality hardware you can trust.

Thanks to the compatibility and quality of the devices we use, we ensure smooth and lasting integration between software and hardware—no surprises, no last-minute fixes.

In industries like retail, entertainment, healthcare, or public services, technology can’t afford to fail. That’s why we choose to work with manufacturers that share our commitment to excellence. Every Elo Touch screen, every Intel processor, every Epson printer, and every Honeywell terminal is part of a bigger solution—designed to perform, last, and grow with your business.

These brands help us go beyond expectations: enhancing your customer experience, streamlining your operations, and making your team’s job easier. That’s the real value of building on a solid foundation.

Today, everyone’s talking about digital transformation. At Qanty, we believe that transformation starts with something as essential as excellent customer service. And to make it happen, you need technology that works—technology that’s tested, proven, and backed by trusted brands.

With Qanty, you’re not just implementing a queue management system—you’re investing in quality.

Top Video Banking Solutions for credit unions: transform member service with human-centered digital banking. As credit unions navigate a rapidly evolving financial services landscape, they face growing pressure to offer convenient and personalized digital experiences. Video banking has emerged as a powerful tool, enabling them to maintain close, face-to-face service while improving accessibility and operational efficiency. In this article, we explore the top video banking platforms helping credit unions succeed in today’s digital-first environment.

Video banking bridges the gap between in-branch service and digital banking. It allows members to connect face-to-face with credit union representatives through secure video channels—either from their home, a mobile device, or a dedicated kiosk in a branch or remote location.

Key benefits include:

Best for: Appointment-driven video banking and member engagement

Coconut Software provides a powerful scheduling and engagement platform tailored to credit unions and banks. Its video banking capabilities are tightly integrated with appointment booking and queue management tools, ensuring a smooth and timely experience for members.

Key Features:

Coconut stands out for helping credit unions reduce no-shows, boost operational efficiency, and create seamless omnichannel member journeys—from booking to video call.

Best for: Scheduling and knowledgebase integration

While known primarily for appointment scheduling, Engageware also integrates with video conferencing tools and knowledgebases to power secure, scheduled video banking experiences. It’s ideal for credit unions that want to streamline complex member services like loan applications or financial planning.

Key Features:

Best for: Smart queueing and scalable video banking

Qanty combines a virtual queue management system with video banking to offer a modern, fully integrated solution for credit unions. It allows members to join a virtual line, get notified of their turn, and connect via secure video—all without waiting in physical branches.

Key Features:

Qanty is especially useful for credit unions aiming to manage both walk-in and remote interactions efficiently, ensuring no member is left behind.

When selecting a video banking solution, credit unions should consider:

Video banking is no longer a luxury. It is a necessity for credit unions aiming to deliver modern, high-touch service in a digital world. Top Video Banking Solutions for credit unions help transform member service with human-centered digital banking, making it easier to enhance remote accessibility, reduce operational costs, and strengthen member relationships. Choosing the right platform can truly be a game changer.

By carefully evaluating the platforms above, credit unions can make informed decisions that align with their strategic goals, IT capabilities, and member expectations.

Service graders allow for effective service evaluation by collecting real-time satisfaction surveys. User feedback is gathered immediately, providing valuable insights to improve service quality and customer experience.

Service graders are tools designed to measure the quality of service in real time. They enable customers to provide instant feedback on the service they receive. These devices are strategically placed in locations where users can quickly and easily rate their experience. This provides accurate data on staff performance and service quality.

One of the key benefits of service graders is the ability to obtain satisfaction surveys instantly. Customers rate the service while receiving attention, ensuring that the data is relevant and up-to-date. This immediate feedback is essential for businesses aiming to continuously improve the customer experience. Having accurate and timely information enables companies to quickly identify areas for improvement.

Service graders help manage the customer experience more effectively by focusing on specific aspects of service. Responses focus on the service provided at that moment, delivering relevant data for evaluating service quality. This information enables quick decision-making to adjust the service in real time and ensure customer satisfaction.

Additionally, using feedback systems helps create a more organized and fair environment. Every customer has the opportunity to rate their experience equitably, improving the company’s image. The system ensures that each user can share their feedback without disrupting daily operations, fostering trust in the organization.

Service graders offer businesses an effective way to measure and improve service quality. With the ability to gather real-time feedback, companies can optimize not just daily operations, but also their relationship with customers. This approach provides a clear view of what is happening during the service, enabling quick and precise adjustments. Implementing this system boosts efficiency and strengthens customer trust and satisfaction, which is crucial in a competitive market.

Using customer satisfaction tools enables immediate feedback, facilitating quick adjustments to enhance the customer experience and strengthen satisfaction.

Improve your service quality and receive real-time feedback with Qanty’s service graders. Obtain satisfaction surveys instantly and make fast, effective decisions. Optimize your customer experience and increase operational efficiency. Start today with Qanty and transform your customer service!

Queue management systems are transforming various sectors such as healthcare, banking, retail, entertainment, and transportation by improving customer experience and optimizing operational efficiency. These systems help manage the flow of people more effectively, reduce wait times, and provide real-time updates. Their implementation enables faster and more efficient customer service, providing a significant competitive advantage for businesses that adopt them.

Queue management systems are revolutionizing how organizations optimize their operations and enhance the customer experience. These systems efficiently manage the flow of people in key sectors such as healthcare, banking, retail, entertainment, and transportation. By reducing wait times and streamlining interactions, businesses not only increase productivity but also gain a competitive edge in an increasingly demanding environment.

In healthcare, these systems are essential for improving patient care. In hospitals and clinics, prioritizing cases based on severity helps reduce wait times in critical areas such as emergency rooms and consultations. Additionally, these tools provide real-time tracking of waits, offering instant updates to patients and enhancing their customer experience. Operational efficiency is also increased by reducing congestion in service areas, thus optimizing the use of medical resources.

In the banking sector, operational efficiency is crucial, and queue management tools offer a practical solution for organizing customer flows. These technologies enable dynamic resource allocation, prioritizing tasks based on demand, which reduces the workload at branches. By implementing these solutions, banks improve customer experience with features like virtual appointment scheduling, minimizing the need for in-person visits. Shorter wait times increase satisfaction and customer loyalty.

The public sector, with its high volume of users, also benefits greatly from these systems. Government offices implement virtual tickets that allow citizens to know their estimated wait time and receive notifications on the status of their services. This organization not only enhances the customer experience but also increases operational efficiency by preventing overcrowding and reducing unnecessary travel. The use of digital tools optimizes human resources and speeds up bureaucratic processes, contributing to the digital transformation of public services.

In retail, these systems are essential for enhancing customer experience in physical stores and shopping malls. They organize lines, making it easier to allocate staff according to customer demand, especially during peak times. Additionally, they use analytics to predict customer flows and organize queues more efficiently, minimizing wait times. This directly impacts the customer experience, as quicker service leads to higher satisfaction and customer retention, driving the digital transformation of retail operations.

The entertainment sector, including cinemas and theme parks, has also found these systems to be a valuable tool for organizing access to events and attractions. They manage ticket sales, entry points, and queues to ensure a smooth experience for visitors. By reducing congestion, they enhance the customer experience and optimize the flow of people, allowing companies to offer quality service, benefiting from operational efficiency.

In sectors like transportation, where punctuality is crucial, queue management tools play a vital role. Airports and train stations use these systems to manage check-ins, security checks, and boarding, reducing the risk of overcrowding and ensuring that passengers can complete their processes more quickly and efficiently. This improves both the customer experience and operational efficiency in the sector, contributing to the overall digital transformation of transportation.

Queue management systems are key to optimizing customer experience and maximizing operational efficiency, driving business competitiveness.

Ready to take your service to the next level and improve your business’s operational efficiency?

With our queue management systems, you’ll optimize your customers’ experience and reduce wait times. Contact us today and let us show you how our solution can transform your operations. We are here to help you take that important step into the future!

Queue management automation has become an indispensable tool in sectors such as healthcare, retail, and hospitality, revolutionizing turn management and improving the customer experience. By eliminating physical lines, this technology allows users to manage their turns via mobile applications and real-time notification systems, optimizing their time. Additionally, it promotes inclusion by automatically prioritizing individuals with special needs, enhancing the positive perception of businesses. The digitization of processes minimizes common errors found in manual systems and allows real-time data analysis to adjust resources and respond to demands efficiently, boosting productivity and positioning businesses as leaders in innovation.

Queue automation has evolved from an optional tool to a central element in the operational strategy of businesses in sectors like healthcare, retail, and hospitality. This type of technology not only reorganizes turn management but also redefines the interaction between users and organizations, creating smoother and more personalized experiences while optimizing internal resources.

Inclusion is another key aspect of these solutions. By automatically prioritizing elderly individuals, pregnant women, or those with disabilities, systems ensure equitable treatment tailored to the needs of each customer. This not only strengthens a company’s reputation as a socially responsible entity but also enhances the customer experience by ensuring each user feels valued.

From an operational perspective, turn management automation provides businesses with a powerful tool for strategic planning. Real-time data, such as user flows or wait times, enables the identification of patterns and forecasting of demand. This facilitates more efficient resource allocation, ensuring sufficient staff during peak periods and avoiding waste during low-demand times. For instance, a hospital can reorganize doctor availability based on daily needs, while a retailer can adjust its inventory to serve customers during key times.

Furthermore, the digitization of processes minimizes errors associated with traditional systems. In a manual model, lack of precision in queue management can lead to delays and frustration for both users and staff. Automated systems eliminate these failures by operating with algorithms that ensure precise and agile allocation, resulting in a more orderly workflow.

In the long term, this technology fosters a cycle of continuous improvement. By constantly evaluating the data generated, businesses can adjust their processes to optimally meet the changing needs of their customers and employees. This not only increases productivity but also boosts adaptability in a dynamic business environment.

Did you know that queue automation not only organizes turns but also personalizes the experience by identifying each customer’s unique needs in real time?

At Qanty, we are here to help you implement solutions tailored to your business needs. Feel free to contact us! We’d be happy to explore how we can elevate your business management to new heights and make it more efficient than ever.

Artificial Intelligence is revolutionizing the customer experience by automating interactions, personalizing services, and optimizing operations. This technological advancement enables businesses to break down language barriers, enhance customer satisfaction, and reduce costs, positioning them as leaders in a globalized market. Additionally, AI in customer service facilitates quick and consistent responses, even during peak demand times, while its real-time analytics capabilities drive personalization and foster customer loyalty. Implementing AI solutions in customer experience (CX) is not just a step toward innovation; it is a key strategy for achieving a sustainable competitive advantage.

Artificial Intelligence (AI) is marking a pivotal shift in how businesses interact with their customers. Thanks to process automation and real-time analytics, interactions are now faster, more personalized, and more efficient. This technological breakthrough is redefining the customer experience (CX), enabling not only greater satisfaction but also strengthening brand loyalty.

AI in CX goes beyond solving immediate issues. It has become a strategic tool for reducing costs, overcoming language barriers, and ensuring consistent, high-quality service. Companies of all sizes are adopting these solutions to stay competitive in a globalized market.

In a world where consumer expectations are ever-increasing, Artificial Intelligence (AI) emerges as a crucial solution. Through virtual assistants for businesses, common queries such as order tracking or product information can be addressed instantly and accurately. This not only reduces wait times but also significantly enhances the customer’s perception of the brand.

AI’s ability to automate processes and handle large volumes of simultaneous interactions is especially valuable during high-demand seasons. Additionally, its integration with existing tools like CRM systems and websites makes it adaptable to any business model.

One of the greatest contributions of Artificial Intelligence (AI) to the customer experience (CX) is its ability to personalize. By analyzing historical data and behavioral patterns, these tools can anticipate customer needs and provide relevant solutions. For example, if a user searches for a product, AI can suggest complementary options or send helpful reminders.

In addition to enhancing the immediate experience, this personalization fosters loyalty. Consumers tend to prefer brands that understand their needs and save them time. On the other hand, real-time analytics provide valuable insights for businesses, helping them identify trends, improve products, and optimize business strategies.

In a globalized world, overcoming language barriers is key to delivering inclusive and efficient customer service. AI’s multilingual capabilities enable businesses to serve diverse audiences without compromising the quality of interaction. This broadens business opportunities and strengthens customer engagement across various regions.

The implementation of these technologies also allows human teams to focus on more complex and strategic tasks, while process automation handles repetitive interactions.

The adoption of Artificial Intelligence (AI) in customer service is not just a trend but a strategic necessity. Its ability to enhance customer experience (CX), optimize resources, and provide real-time analytics positions it as an indispensable tool for businesses looking to stand out in an increasingly competitive market.

Artificial Intelligence is redefining how companies connect with their customers, ensuring a sustainable advantage that positions them as leaders in a competitive marketplace.

Adopting Artificial Intelligence is not just a technological upgrade, but a strategic shift that can make the difference between thriving or falling behind. Learn how to integrate this innovation into your business and secure your position as an industry leader. The time to act is now! Contact us at Qanty and discover how we can help transform your business strategy.